About IIMS

The IIMS provides a total customer-centric solution for Insurers

which covers all key operational functions, for example, product

development, marketing, intermediary management, underwriting,

policy management, reinsurance, claims, payment and accounts.

Although designed on a modular basis, all the various functions

are seamlessly integrated. Requirements for quick and real time

information may be obtained with little hassle to make important

operational decisions. IIMS also incorporates the e-CMS (or

electronic Claims Management System) which can be implemented on

a stand-alone basis, if needed.

The e-CMS incorporates a built-in workflow and document

management system which helps to avoid the current shortcomings

of claims operations. The workflow system allows different

setups for the various products by product type, loss amount,

loss type, etc to ensure the different processes within the set

benchmarks are consistently met. The system is able to monitor

the performance of the staff and for work to be reassigned in

the event of bottlenecks.

The IIMS system is able to cater for self rating where details

of the customer keyed in during assessment are checked against

the underwriting guide to determine the acceptance and rates

chargeable invariably speeding up the processing time.

The IIMS platform supports multiple languages and currencies.

Both the IIMS and e-CMS were designed with a 3-tier architecture

and were developed to the Java J2EE MVC 2 Model which allows for

easy integration to other systems conforming to the standard.

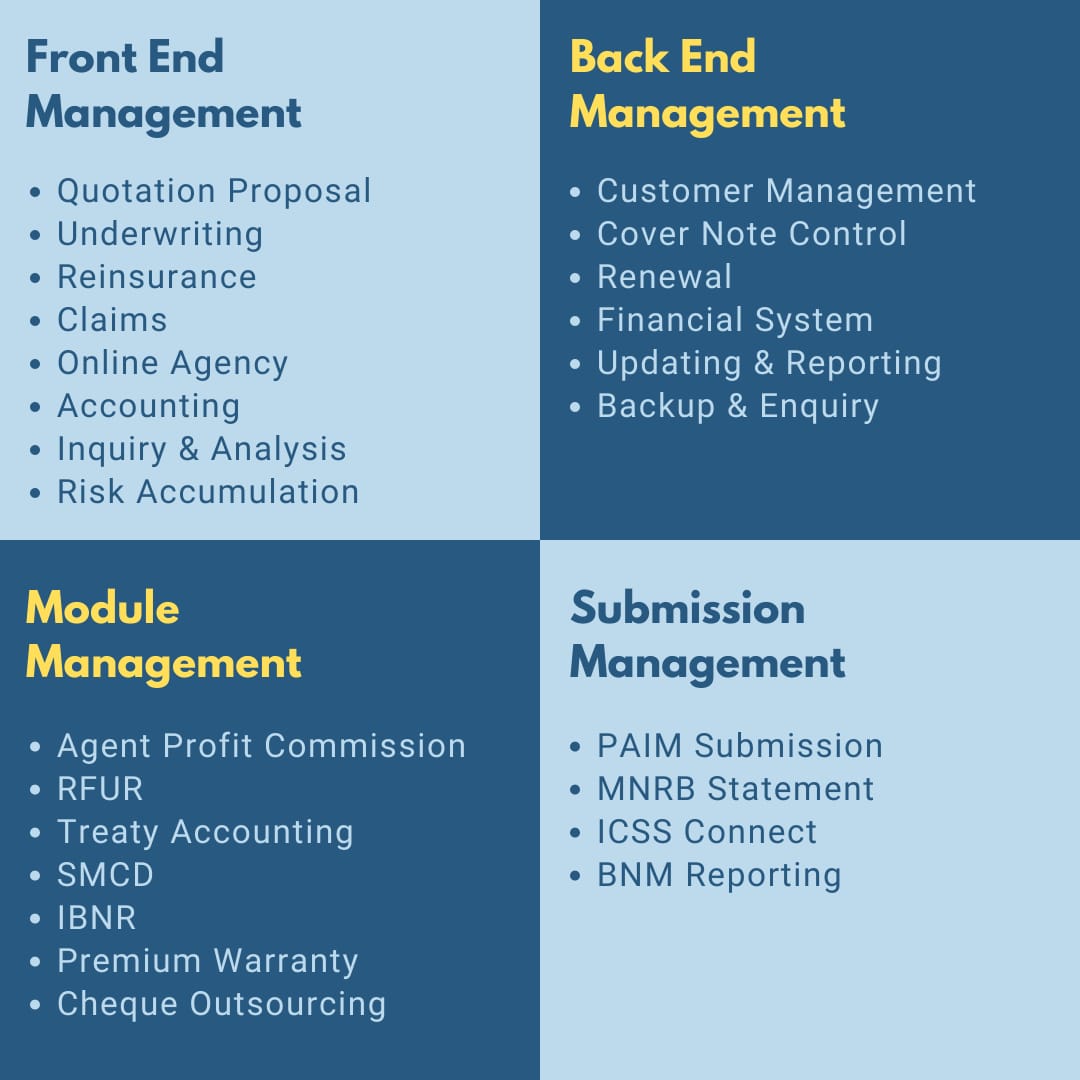

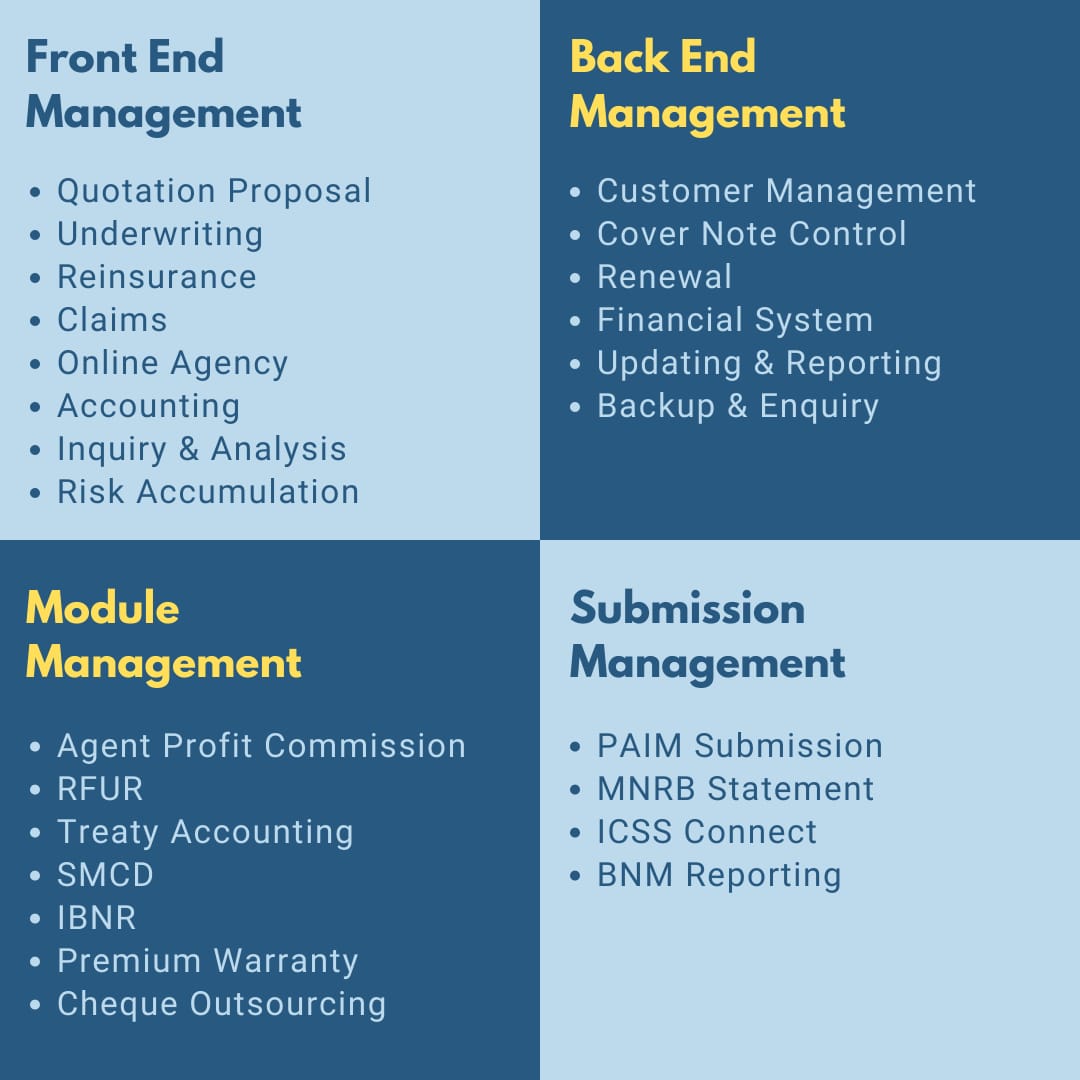

How Does The System Work?

IIMS is a complete web-based end-to-end solution enabling the

insurer to manage its customers at all phases of their policy

life-cycle from front-end and back-end management to module

management and submission management.

At the front-end, it manages activities such as quotation or

proposal, underwriting, reinsurance, claims, online agency

management, accounting, enquiry & analysis and risk

accumulation.

At the back-end, daily activities including policy and customer

management, cover note control, policy renewals, financial

system, updating & reporting and backup & recovery are managed

by the back-end management modules.

Its various modules allow for the tracking of agents profit

commission, RFUR, treaty accounting, SMCD, IBNR and premium

warranty to ensure that adequate statutory reserves are being

provided and that the insurance company’s operations conform to

regulatory guidelines. Other modules cater cheque outsourcing,

risk accumulation on a real-time basis, etc.

The submission management modules provides for various

statements and reports, which are required by management,

industry and regulatory bodies.

IIMS is designed to suit existing processes of insurers and

supports the entire value-chain of the business (agents,

brokers, suppliers, internal departments, users, customers and

regulators).

The following diagram represents an overview of IIMS:

IIMS is designed to be implemented across all business units and

product lines of a general insurance company.

Its flexible architecture allows the system to adapt to changing

business conditions and requirements. The system is very agile

and has the necessary speed to market to maintain the

competitiveness of the company. The scalable architecture allows

the solution to be implemented for companies of various sizes,

and supporting their subsequent growth.

Key Functionalities

IIMS is a modular yet fully integrated insurance processing

system that supports the business and processes of General

Insurance companies operating in today’s competitive and dynamic

markets. The comprehensive functionalities provided by IIMS are

developed exclusively for the industry, to make every step of

the processes faster, easier, and accurate. The flexible

architecture supports user business and workflow processes,

helps improve operational efficiency and reduce costs.

Key functionalities include:

-

Web based application enables rapid deployment and

connectivity for all users anytime anywhere.

-

Supports all classes of General Insurance and all processes

with functionalities such as:-

-

Marketing, intermediary and channel management, whole

policy lifecycle – policy administration (new business,

renewal, endorsement, cancellation), accounting, agent’s

commission and statement, underwriting, risk assessment,

risk accumulation, claims handling (registration, loss

adjustment, reinsurance, etc.

-

Provides management information reporting and report

writer including indices.

- Financials (AR, AP, GL, recovery)

- Agents Commission and Statements

-

Statutory reporting and statistics– Central Bank and

Industry Group

-

Customer-centric RDMS (Relational Database Management System)

provides a single view of the policyholder in order for the

insurer to accurately profile and understand their customers’

needs.

-

Central electronic repository of data and files enabling

common paperless access and real-time sharing of information

and data either by staff, agents or systems.

-

Electronic work-flow(routing, approvals and alerts) ensures

systematic and structured claims processing life cycle. It

also provides tracking of processing time and productivity.

-

Automated processes supporting reconciliation, claims

recovery, payment, salvage and others.

-

Modular design allows an Insurer to purchase the modules

individually as standalone applications.

-

Fast time to market due to configurable and parameterised

system architecture means that the system is readily adaptable

to any business process or requirement in a short time span

with minimal customisations.

-

3 Tiered architecture (Model View Control) keeps the business

logic completely separate from the control and view logic,

making it very easy to add new views to the application.

-

Developed in compliance to J2EE specification standard which

allows for easy integration to other systems conforming to the

standard Customer Relationship Management module where the

data of insured captured may be further analysed and utilised

to the insurers' benefit.

- The systems supports multiple languages and currencies.

Effective Control Measures

The IIMS solution includes the following features:

-

Blacklisted Control

An alert is generated when a vehicle number or engine number

or chassis number is found within the blacklist table and the

transaction will be blocked.

-

Risk Accumulation Alert

An alert will be triggered if the company exposure (sum

insured) is exceeding the pre-setup risk limit set in the

system such as by the risk location or by the project basis.

-

Treaty Placement Arrangement

The reinsurer participates with a fixed share in all the risks

accepted in the class of business by the treaty. The quota

share profile can be setup in the IIMS module. The cedant's

and reinsurer's participations are fixed share based on

certain percentage of each risk written by the cedant. The

percentage is agreed as from inception of the treaty and used

as a basis for the apportionment of premiums and claims whilst

the treaty is in force.

-

Excess Of Loss Handling

The total amount of excess of loss reinsurance protection

which a company needs to protect a given set of exposures is

usually not written in one contract. Instead, the total amount

is split into layers (IIMS can set the treaty limit and

support upto 5 layers) and separate contracts are written

which fit on top of each other and have similar or identical

terms but separate limits which sum to the total amount

required.

-

Efficient management of claim data and files

With the document imaging capability of storing digitized

images of files, which allows for faster recall of information

and less downtime due to lost or misplaced physical files.

-

Elimination of delays and errors of manually entering new

and duplicate information

IIMS is the client centric module which the details of insured

captured during policy processing need not be keyed in again

in the claims module in the event of a claim which also

accelerates processing time. The client information will be

pulled over from underwriting to claim and the information

can't be edited.

-

Claim Payment Approval

IIMS is designed with build in workflow functionality, the

claim payment required 2 stages of approval based on the limit

set in the profile.

-

Receipting

IIMS enable to print receipts for the premiums received from

policyholders or claim recovery received using the receipting

functionality. It allowed to offset the policy or endorsement

transaction. No amendment is allowed once the receipt is

printed.

Product Modules of IIMS

IIMS supports the various classes of general insurance with the

Base Software consisting of the following:-

Class Modules

- Underwriting Module For Motor

- Underwriting Module For Fire

- Underwriting Module For Bond

- Underwriting Module For Engineering

- Underwriting Module For Workmen Compensation

- Underwriting Module For Miscellaneous Accident

- Underwriting Module For Liability

- Underwriting Module For Marine

- Underwriting Module For Personal Accident

- Underwriting Module For Health

IIMS is designed to support the processes of General Insurance

companies at all phases of its business life-cycle and the

following operational modules are in built to fully support all

the classes of insurances as provided.

Operational Modules

- System Admin/Security/Code Master Module

- Agency and Marketing Module

- Quotation Module

- Cover Note Module

- Package Policy Module

- Installment Module

- Risk Accumulation Module

- Reinsurance Module

- Claims Module

- Renewal Module

- Insurance Accounting Module

- Financial Module (General Ledger)

- Treaty Accounting Module

- Agent Profit Commission Module

- Reserve for Unexpired Risk Module

- Premium Warranty Module

- Incurred But Not Reported Module

- Statement of Movement of Claims Module

-

Production Reporting Module (configurable by branch, SBU,

client, intermediary, class, etc)

- Production Enquiry Module (Real-Time)

- Month-end Processing Module

- Statutory Reporting Module

Benefits of IIMS

-

Quick time to market as the system is easily

configurable to suit the user’s business requirements and is

quickly adaptable to the changing market trends.

-

Optimises the utilisation of resources by identifying

and streamlining cumbersome business processes.

-

Elimination of delays and errors of manually entering new

and duplicative information;

for example details of insured captured during policy

processing in the marketing module need not be keyed in again

in the claims module in the event of a claim which also

accelerates processing time.

-

Automated process management enables audit reviews and

business process re-engineering for continuous improvement.

-

Efficient management of integrated backend data and

files due to the document imaging capability of storing

digitized images of files, which allows for faster recall of

information and less downtime due to lost or misplaced

physical files.

-

Low risks in implementation as IIMS is designed from

the ground up for the insurance industry related processes. To

adapt the system to existing processes merely some

configuration and minimal customization.